Investiva Performance

A Report on Investiva’s performance between November 2022 and June 2023.

Investiva is a groundbreaking, fully autonomous trading platform that harnesses the power of Deep Reinforcement Learning (DRL) to optimise investment strategies.

At its core, Investiva leverages DRL, an advanced subset of machine learning, to enable the platform to learn and adapt in real time based on market conditions. By utilising this cutting-edge technology, Investiva’s algorithms continually analyse vast amounts of historical and real-time market data to identify profitable investment opportunities and optimise trading decisions.

Last November 2022, we started to trade using Investiva with a small test account in the US stock markets, Nasdaq & NYSE. Our aim was not only to outperform the major market indices but also to emphasise investing solely in ESG (Environmental, Social, and Governance) friendly companies while ensuring robust risk management.

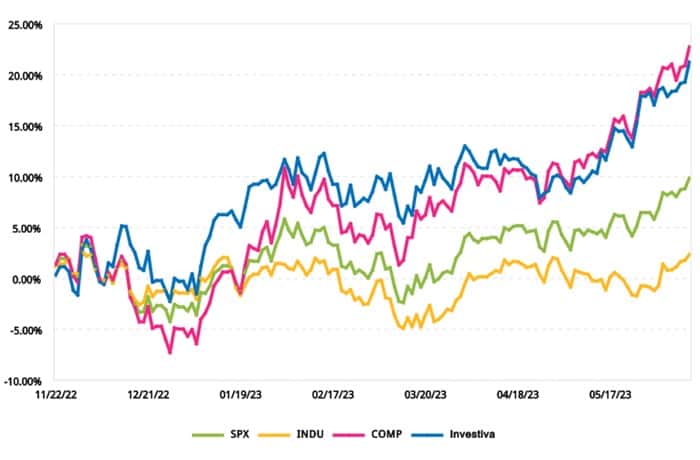

During this test period, Investiva consistently outperformed the major market indices. This article summarises our findings.

Key Statistics

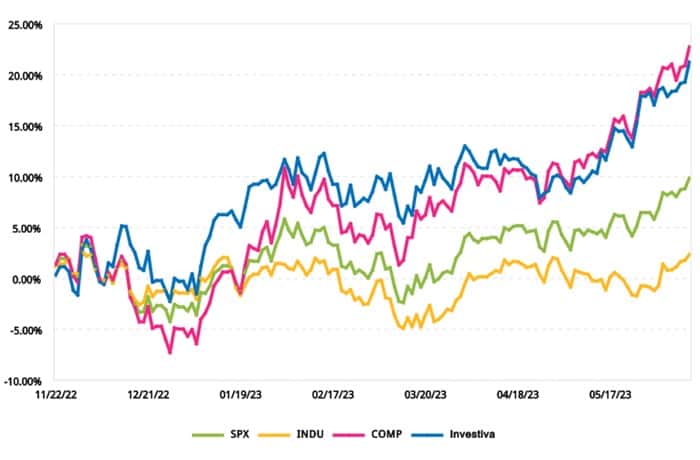

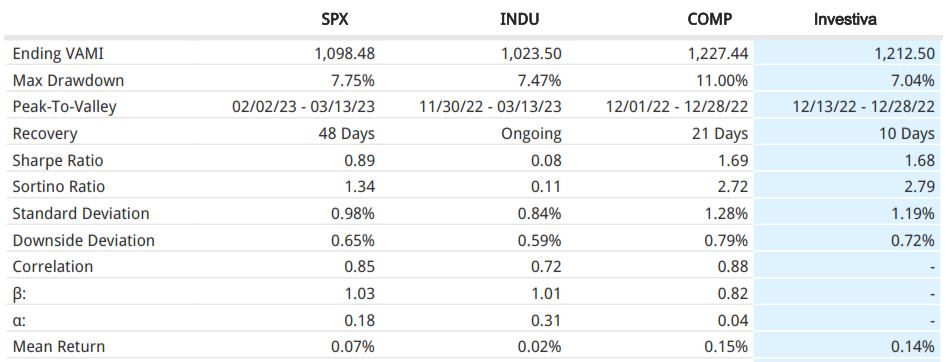

Investiva achieved 21.25% cumulative returns while maintaining balanced risk management with a Sharpe ratio of 1.68, a Sortino ratio of 2.79, a maximum drawdown of 7.04%, and a recovery time of 10 days.

Investiva only entered long positions in this test period. No short selling was used.

Benchmark Performance Comparisons

Investiva managed to outperform the Dow Jones Industrial Average Index (INDU) and the S&P 500 Index (SPX) while outperforming the NASDAQ Composite Index (COMP) during most periods consistently.

While outperforming most market indices, Investiva also had the lowest “Max Drawdown”, the shortest recovery period, and the highest Sortino ratio. By constantly monitoring market volatility, liquidity, and other relevant factors, Investiva strives to minimise downside risks and preserve capital.

An ESG Outlook

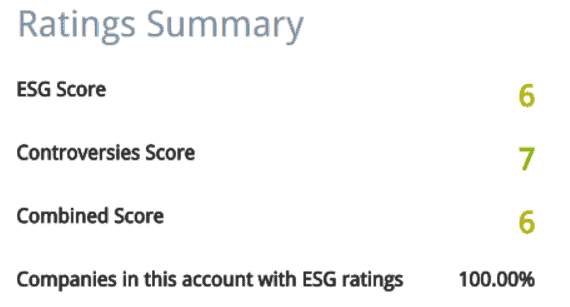

100% of stocks in this test account have ESG ratings. The portfolio has a Controversy Score of 7 and an overall ESG Score of 6. We are keen to invest in companies demonstrating strong environmental sustainability, positive social impact, and ethical governance practices.

In summary, our autonomous trading algorithms outperformed the major market indices while exclusively investing in ESG-friendly companies. By integrating responsible investing principles and implementing robust risk management techniques, Investiva aims to deliver superior returns to investors while promoting sustainability and ethical business practices.